Award-winning PDF software

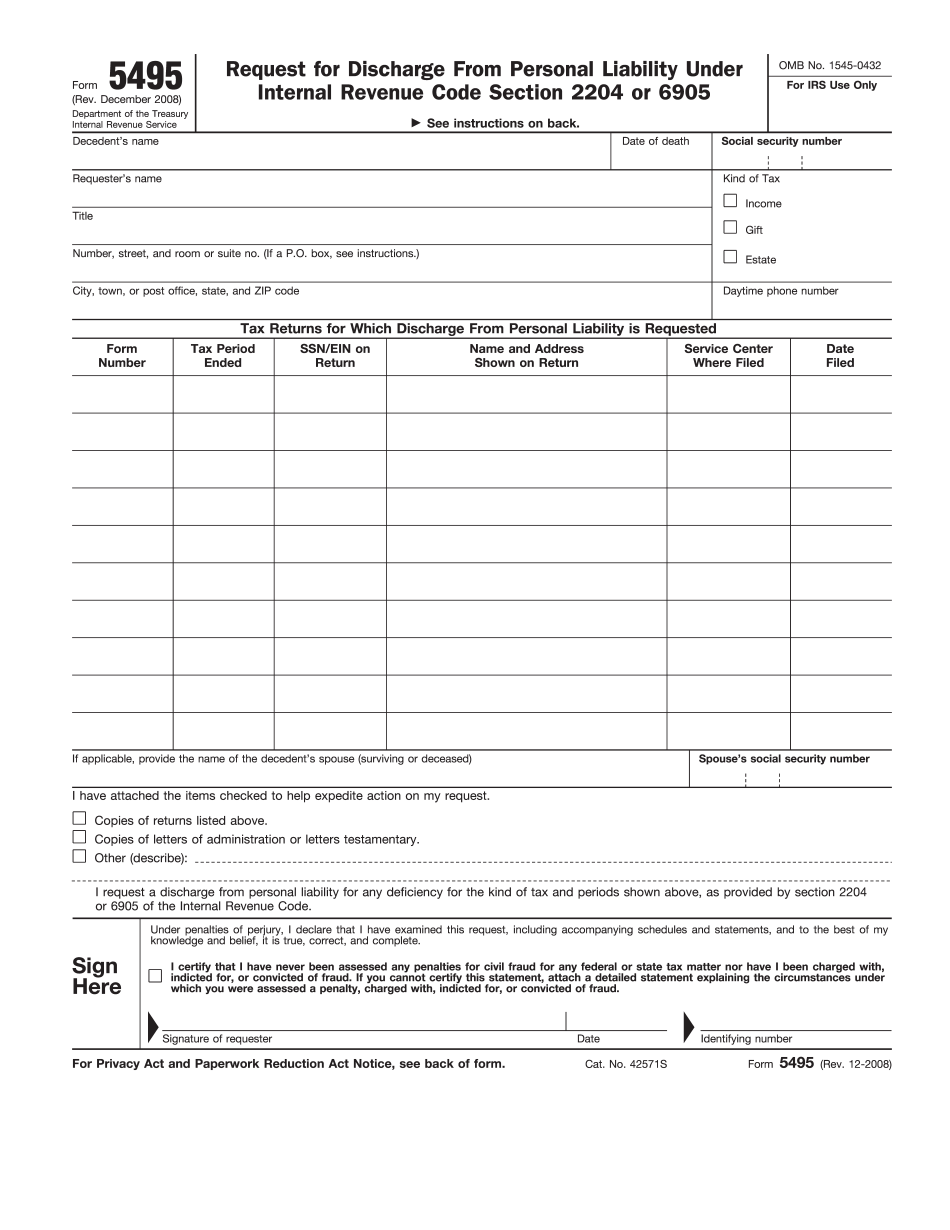

Miami-Dade Florida Form 5495: What You Should Know

Fee on Forms 5495 — The State Bar of Texas Form 5495 — Fee on Forms 5495 — The State Bar of Texas Form 5495 — Filing Fees and Forms of Interested Persons — When do Form 5375 and Form 7375 become final and available for distribution? Form 7375 forms can be filed in conjunction with either Form 5375 or Form 7375 to obtain the necessary tax identification numbers Form 5453 — Application for Discharge of Liability to For the purposes of section 5461, “gross debt” means any unsecured debt, secured debt, or liability incurred for the benefit of, at the option of, or on account of the estate of the decedent that would, if the decedent were alive, be subject to levy, attachment, bankruptcy, levy upon or garnishment by any public officer or other entity or any tax under Chapter 13 or Chapter 17 of Title 12, and that either is not secured by personal property or that is secured in the manner described under Sec. 813(a)(1)(A) of this subtitle, and includes any indebtedness that is: a. for education or graduate medical care purposes, in the case of a graduate medical care facility or its affiliates or in the case of any other health care facility (other than a medical assistance health facility) licensed under chapter 6 of Title 8 or 11 of the Nursing Home Construction and Safety Act of 1977, or b. for any other purpose, in the case of a medical assistance health facility or its affiliates, or in the case of any other health care facility Sec. 831 of this subtitle; except that only indebtedness incurred by the decedent during his or her lifetime on or after the first day of the tax year shall be considered gross. Fee on Form 5375 and Form 4375 — The State Bar of Texas Sec. 831(a) of this subtitle; except that only indebtedness incurred by the decedent during his or her lifetime on or after the first day of the tax year shall be considered gross. Sec. 831 of this subtitle; except that only indebtedness incurred by the decedent during his or her lifetime on or after the first day of the tax year shall be considered gross. Sec.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Miami-Dade Florida Form 5495, keep away from glitches and furnish it inside a timely method:

How to complete a Miami-Dade Florida Form 5495?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Miami-Dade Florida Form 5495 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Miami-Dade Florida Form 5495 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.