Award-winning PDF software

Printable Form 5495 Saint Paul Minnesota: What You Should Know

Click Here for more info regarding Form 5495 Form 5498 — Affidavit Regarding Your Identity For anyone with over 75,000 of annual gross income on his or her tax return: If an individual or organization wants to change the name, gender or state of address with which people, payments, transfers, and distributions, will be received, then you will need to fill out this form. The purpose for filing is to obtain, by official government record, a certified copy of a state or local official identification document containing an accurate and complete, accurate, and timely description and photo of the individual or organization. The form also contains a certification stating that an effort has been made to obtain an original, certified copy of the document. This form is not required for filing IRS Form 1040, 1040A, or 1040EZ. If any of the information given on the application is invalid, misleading or incomplete, then a copy by official government record is required. Form 5498 shall be signed by all those on the application. In order to have an official government record of such a request, that applicant must provide a sworn application, signed by each individual making such a request. The fee for completing this form is 25.00. All payments made by checks, draft, or cash shall be accepted. Accepted electronic payments are due with this receipt. Failure to receive payment shall result in revocation of such application for identification purposes. A refund of the non-refundable application and processing fees and any payments made in error will be made only in the event of fraud or misuse. (This form is no longer available.) Form 5820 — Change of Address for Tax Return purposes (Form 5973 may also be filled in for such requests and can be filled below this form) You are filing for a change of address to avoid paying tax on the current address where you live. You need to provide a change order from the Department of Revenue for Florida. You may apply online as well. (This Form is no longer available.) When you have filed, you will be issued a Form 5927 which shows the IRS received your application. You will have to use your original records or a copy of your previous record when filling this form if you want to see your status. (Remember, your new employer might change your new address.) This form is no longer available.

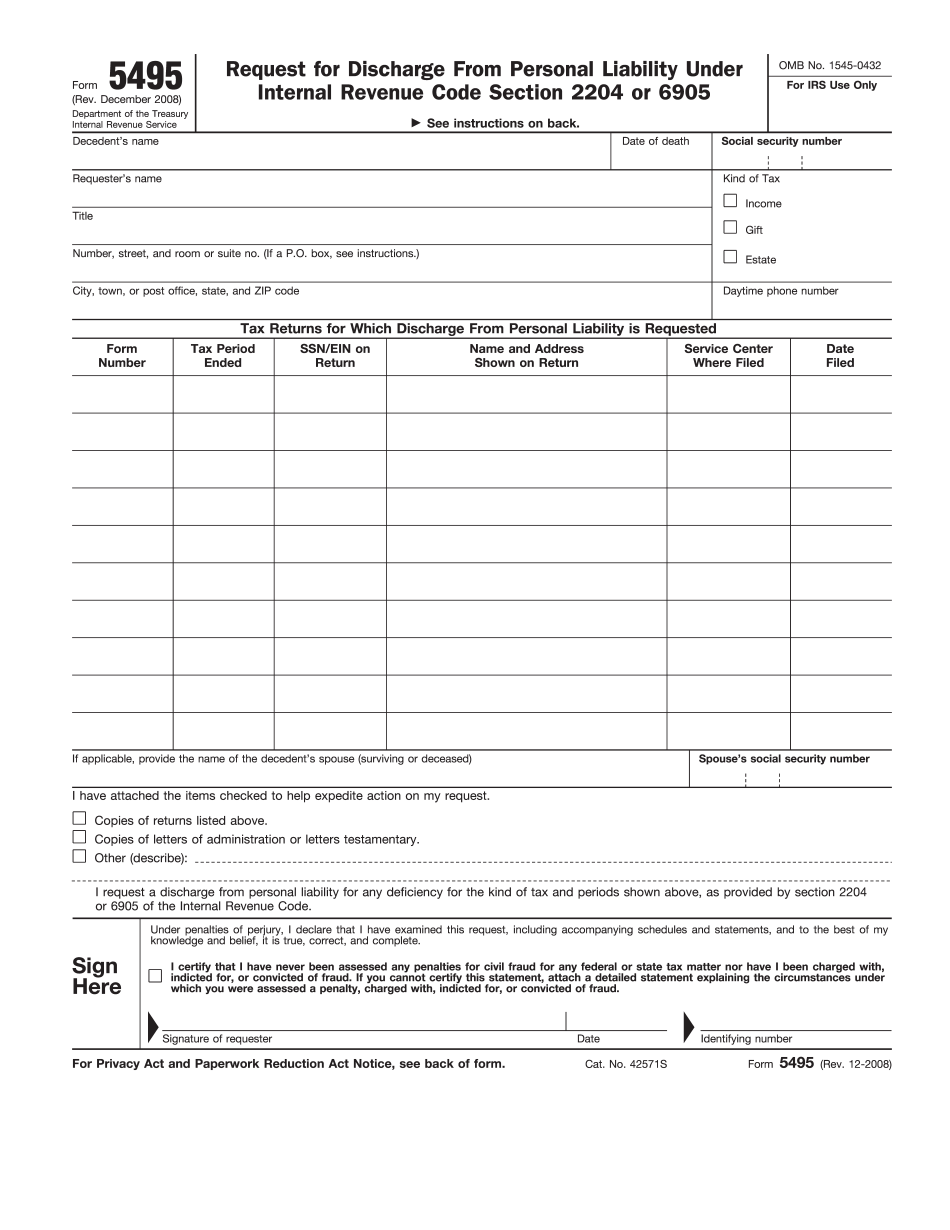

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 5495 Saint Paul Minnesota, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 5495 Saint Paul Minnesota?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 5495 Saint Paul Minnesota aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 5495 Saint Paul Minnesota from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.