Award-winning PDF software

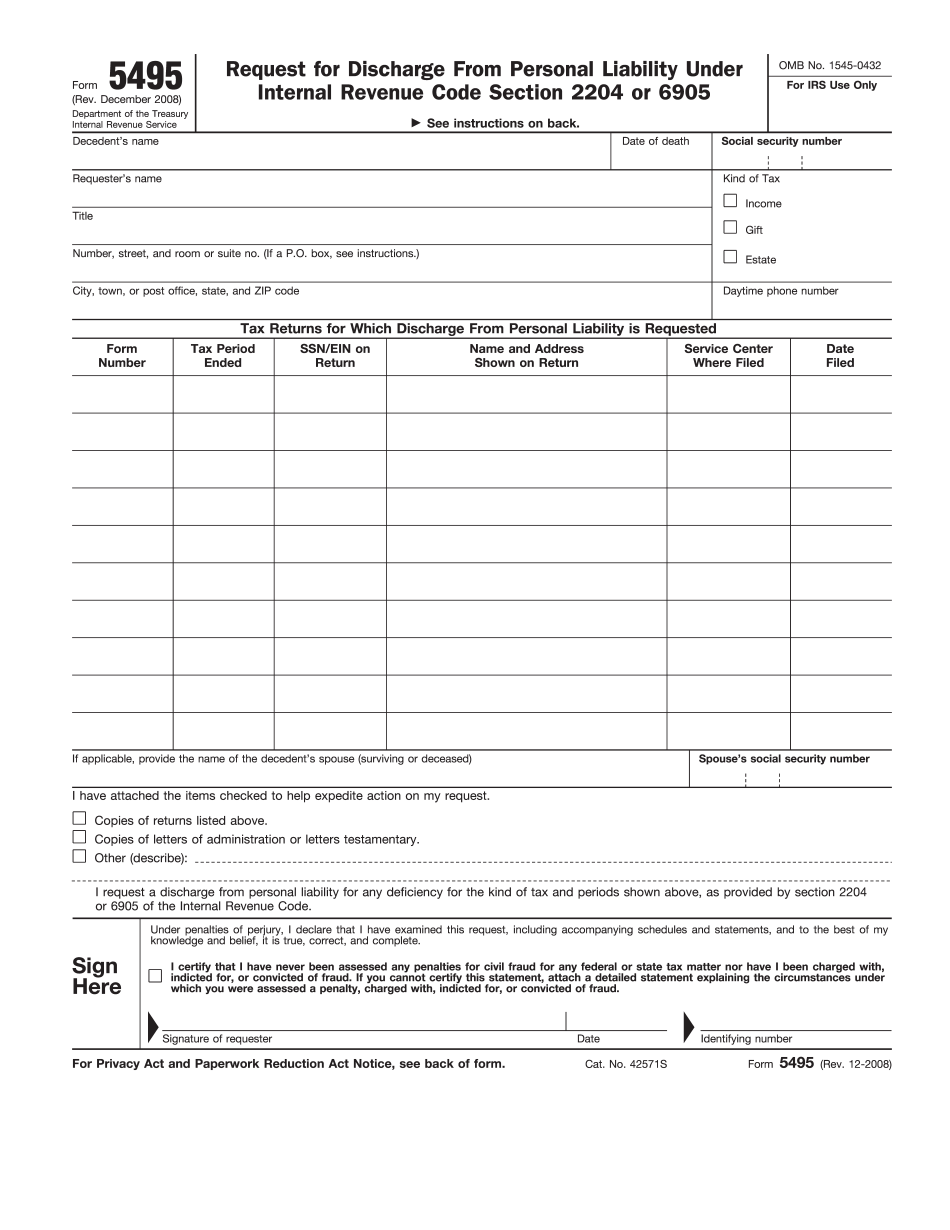

Printable Form 5495 Long Beach California: What You Should Know

Form 5495 one certified copy of the death certificate of your spouse who has died. Your spouse who has died will be listed as “Other Person” on the return. A copy of the death certificate is not required of a surviving spouse or person entitled to file under IRM 20.5.1.9.1.3.13, Death Certificates, and is not a basis for processing a request for the discharge of personal liability under Internal Revenue Code section 2204 or 7055, or Section 6011 to 6015, except for certain individuals. However, to obtain a discharge of personal liability under IRC section 2204 or to avoid the effect of section 7606(a) of the IRC, you will require a copy of the death certificate to attach to Form 5495. You must mail the request to the address of the appropriate Service Center for all tax liabilities and debts that were incurred prior to the death of your spouse. The form must be received by the appropriate Service Center within the specified time period of 30 days (3 months) after the death of a surviving spouse. All income tax withheld by the individual on a Form 1040, line 18, and refunded tax or nonrefundable credits on a Form 1040ES (IRS Information Return due) to an individual, trust, or partnership shall be credited toward the liability if the individual's estate is taxable by the federal government by reason of being an individual taxpayer (i.e., tax withheld or credits otherwise credited to an individual taxpayer), or by reason of being part of a group of individuals that constitutes an individual taxpayer under IRC section 6013. To obtain a discharge from personal liability under IRC section 6050P for the death of a surviving spouse, the deceased's estate must be taxable by the federal government at the estate tax rates prescribed in IRC section 6013. All information must be received by the applicable State Tax Agency within the specified time period specified in the State's statute. The time period generally is 30 days. If you are requesting a discharge of property interests, such as property the deceased owned or controlled, which were not received by the appropriate State Tax Agency within the time period specified by the applicable State statute, you must notify the appropriate Tax Examiners. Additional Requirements This information must be sent to the appropriate office specified by your request and must also include a statement of the type of information to be provided. If your spouse has served you with a divorce decree, he or she may also be listed.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 5495 Long Beach California, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 5495 Long Beach California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 5495 Long Beach California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 5495 Long Beach California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.