Award-winning PDF software

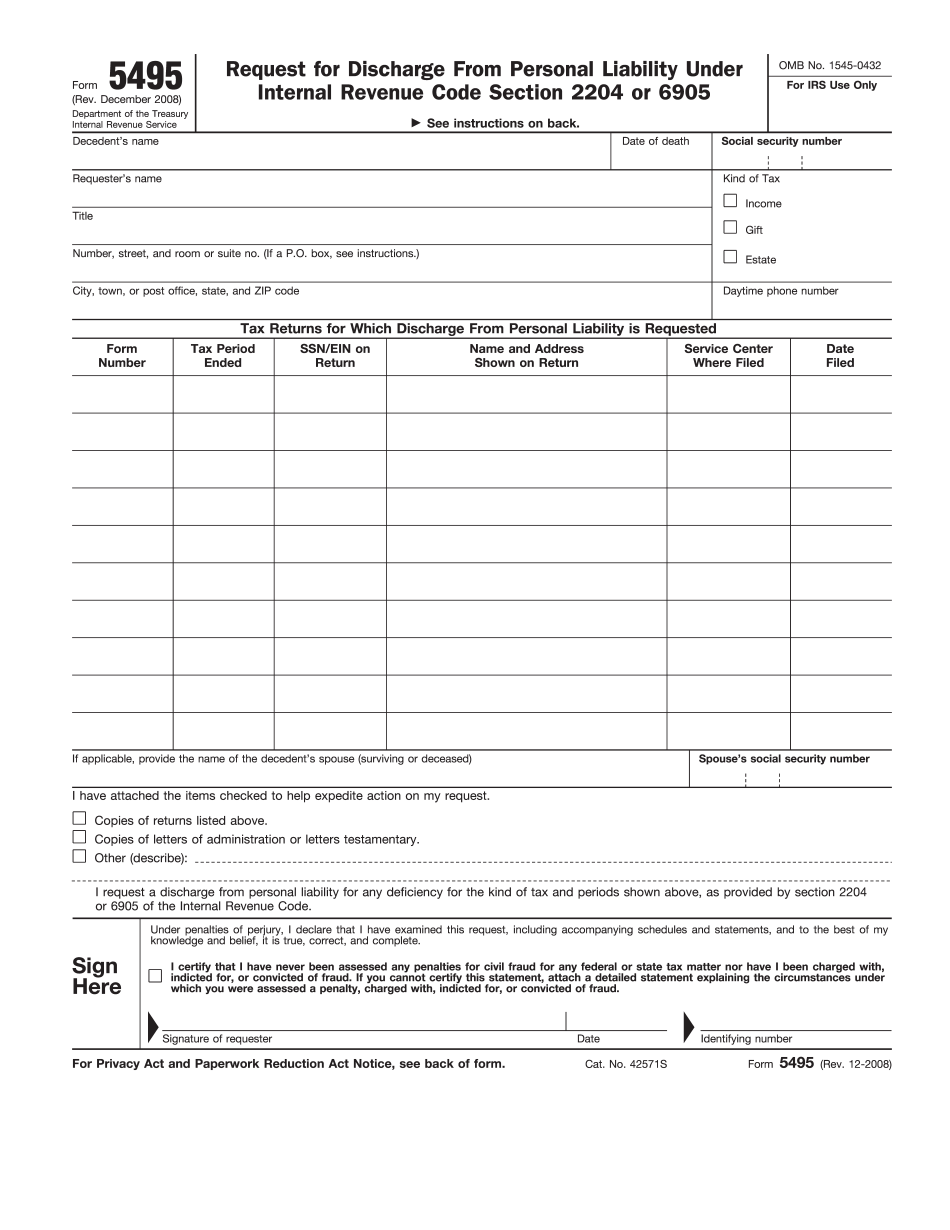

Little Rock Arkansas Form 5495: What You Should Know

Arkansas Courts Department of Revenue — Arkansas Department of Revenue Arkansas Department of Revenue, 1 State Office Building, PO Box 3940, Little Rock, AR 72. Office Hours for the Department are Mon-Fri 8am — 6pm ET. Mail your return as soon as possible and expect it to arrive by 6pm, if they don't receive it by that time, please call and check. Forms and Publications — Arkansas Insurance Commissioner Arkansas Insurance Commissioner, P.O. Box 2489, Little Rock, AR 72205. The main office is a toll-free number. Call or check their website for other locations. How to file a claim for Arkansas Personal and Group Disability Insurance See Arkansas Statutes § 38-26-130(f). How to file a claim for Arkansas Income Taxes As explained on the main page for the Arkansas Department of Revenue, you should file your claim as soon as you file your annual state return. How to receive a refund of Sales Tax for purchases within Arkansas? Arkansas Sales Tax Refund Form. (Please note that the Form 5500 is different from the Form 5498) Arkansas Sales Tax Refund Form. (It's the same as the Form 5498, but the “Sales Tax Refund” field must be filled out first. See the main page of the Department of Revenue website for further details) Arkansas Sales Tax Return. Return. As explained on the main page of the Department of Revenue, you should file your return as soon as you file your annual state return. You must check “Return” after you fill out all the forms correctly for your tax year and/or tax year ending. How to file a claim for a refund for sales tax that you paid in prior years? Note: Form 844-C is not accepted! The claim date is always the return date. If you paid sales taxes on prior year state tax returns, or on prior year local utility bills, you can file for a sales tax refund on those claims instead of the standard general state income tax refund. For more Information, please see the FAQ. How to file a claim for Arkansas Property Tax? Arkansas Property Tax Claim. Arkansas Property Tax Claim with Attestation Form and Photo. Form 5498 — Tax Credit, Penalty, and Interest.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Little Rock Arkansas Form 5495, keep away from glitches and furnish it inside a timely method:

How to complete a Little Rock Arkansas Form 5495?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Little Rock Arkansas Form 5495 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Little Rock Arkansas Form 5495 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.