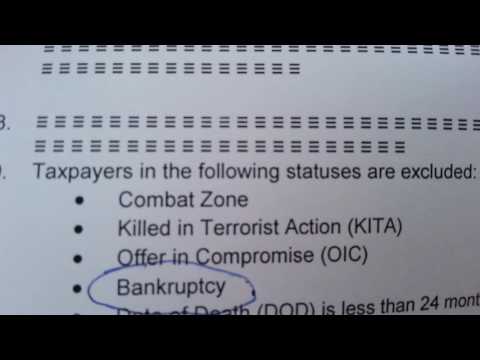

Okay, the purpose of this video is to discuss the five things that can help you stop withholding auto withholding on your paycheck. This refers to when your taxes are being deducted at a higher rate than necessary, and you can only claim up to two allowances. However, if you request more than that, it means your taxes will be filed as if you were a government employee. This would result in a higher tax rate of around 19% to 26%, with a spike at 7% for Social Security tax and Medicare. Now, let's get into the five strategies to help you avoid this locked-in situation: 1. Automate your withholding: You can do this through your employer, not the IRS. Make sure your employer is aware of this and follows through with the necessary changes. 2. Combat zone exemption: If you are serving in a combat zone or if you were killed or injured in action, there are special exemptions that can be applied to your tax situation. Consult with the appropriate government agencies for more information on this. 3. Offer and compromise: If you owe taxes, you may be eligible to negotiate a lower amount to pay through an offer and compromise. It is advisable to seek help from an accountant who specializes in this area, as the paperwork can be complex. 4. Bankruptcy: Depending on your financial situation, filing for bankruptcy under Chapter 7 or Chapter 13 may help you eliminate unsecured debt, such as credit card debt. However, it is crucial to understand the rules and regulations surrounding bankruptcy, as it may have implications on your assets. 5. Update your tax status: If your personal circumstances change, such as marriage, divorce, or having a child, it is important to notify the IRS of these changes. This ensures that your tax withholding is...

Award-winning PDF software

Video instructions and help with filling out and completing Will Form 5495 Withholding