Hi, I'm Ralph with a noise Bay, and I'm gonna explain what Accounts Payable does. But before I begin, we need to know how accounts payable, or AP, walks and talks. The first step AP takes is deciding how to record its transactions. Notice I between a cash or accrual based method. Cash basis accounting is what we experience on an everyday basis. The one in my wallet is the only money I have, so when I purchase say, a coffee, I feel that purchase because I've given the barista my dollars in exchange for a latte. In accrual-based accounting, however, the money is transferred once goods or services are completed. The difference here is that although we may not exchange actual folding bills, that money has indeed transferred hands. So, for example, I sell you a twenty pound bag of roasted coffee. I'll leave an invoice saying you have 30 days to pay me back. As far as I'm concerned, I already have your money, even though you haven't physically paid me. In order for this to work, we need to believe in the accounting equation, which reads assets is equal to the sum of the organization's liabilities and equity. Is that another way a company is the accounting equation? But let's make it a little simpler to follow. We're going to ignore the equity part and focus on the assets and liabilities part. With that, we can introduce accounts payable. But before we take another step, just because accounts receivable is on the other side of the equals does not make it equal to accounts payable. They are just different buckets in an organization, holding time and money. Now that we've taken our first few steps with accounts payable, we're ready to say our first words: double entry...

Award-winning PDF software

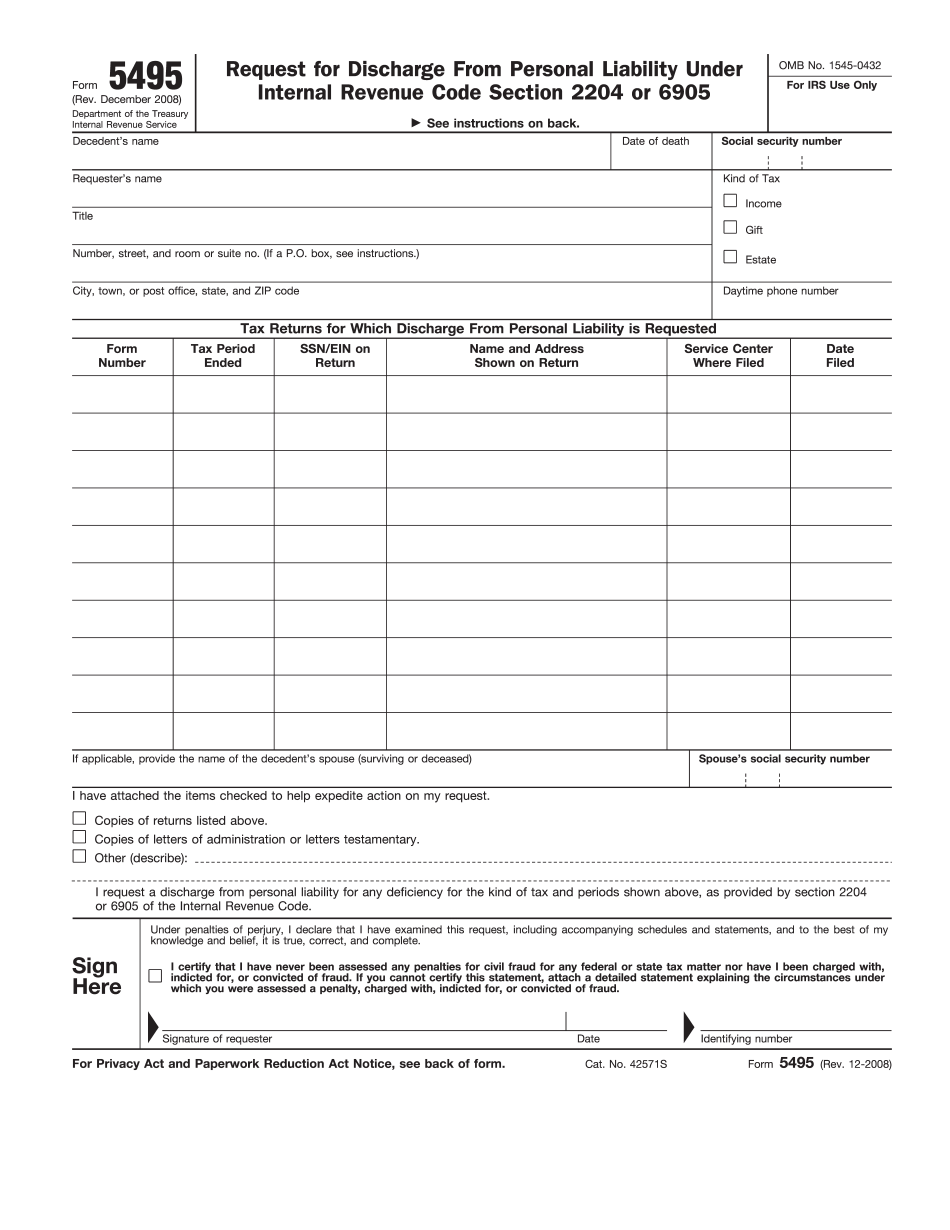

Video instructions and help with filling out and completing Will Form 5495 Payable