Hi, I'm Ben Anders with Innovative Solutions CPAs and Advisors. There's been a lot of uncertainty and anxiety in the US since the passage of the Tax Cuts and Jobs Act in late 2017. This is the first in a series of short videos designed to help clear up some of that confusion. My topic for today will be the changes in the standard and itemized deductions. As you may know, many years ago, with the intention of not taxing people on the money that they need for daily necessities and daily living, Congress created something called itemized deductions. This is a list of expenses that you can deduct before calculating taxable income. If these itemized deductions don't add up to enough, taxpayers can deduct a specified flat amount called the standard deduction on their 2017 tax returns. Many people will itemize their deductions if their total of mortgage interest, property tax, state and local income taxes, charitable donations, and a few other items add up to more than their standard deduction amount. For 2017, the standard deduction amount for individuals is $6,350, and for married couples, it's $12,700. Beginning in 2018, the Tax Cuts and Jobs Act increases the standard deduction for people filing single to $12,000, and for married couples to $24,000. Some people will still itemize their deductions in 2018, but many people will switch to taking the standard deduction. This is because the limits on many common deductible items have been decreased. Here are some of the more important changes: the deduction for state and local taxes, including state and local income taxes, property taxes, and vehicle license fees, has been capped at $10,000 total. This is going to be a big change, especially for people in high-income tax states like California or high property tax states like New Jersey. For...

Award-winning PDF software

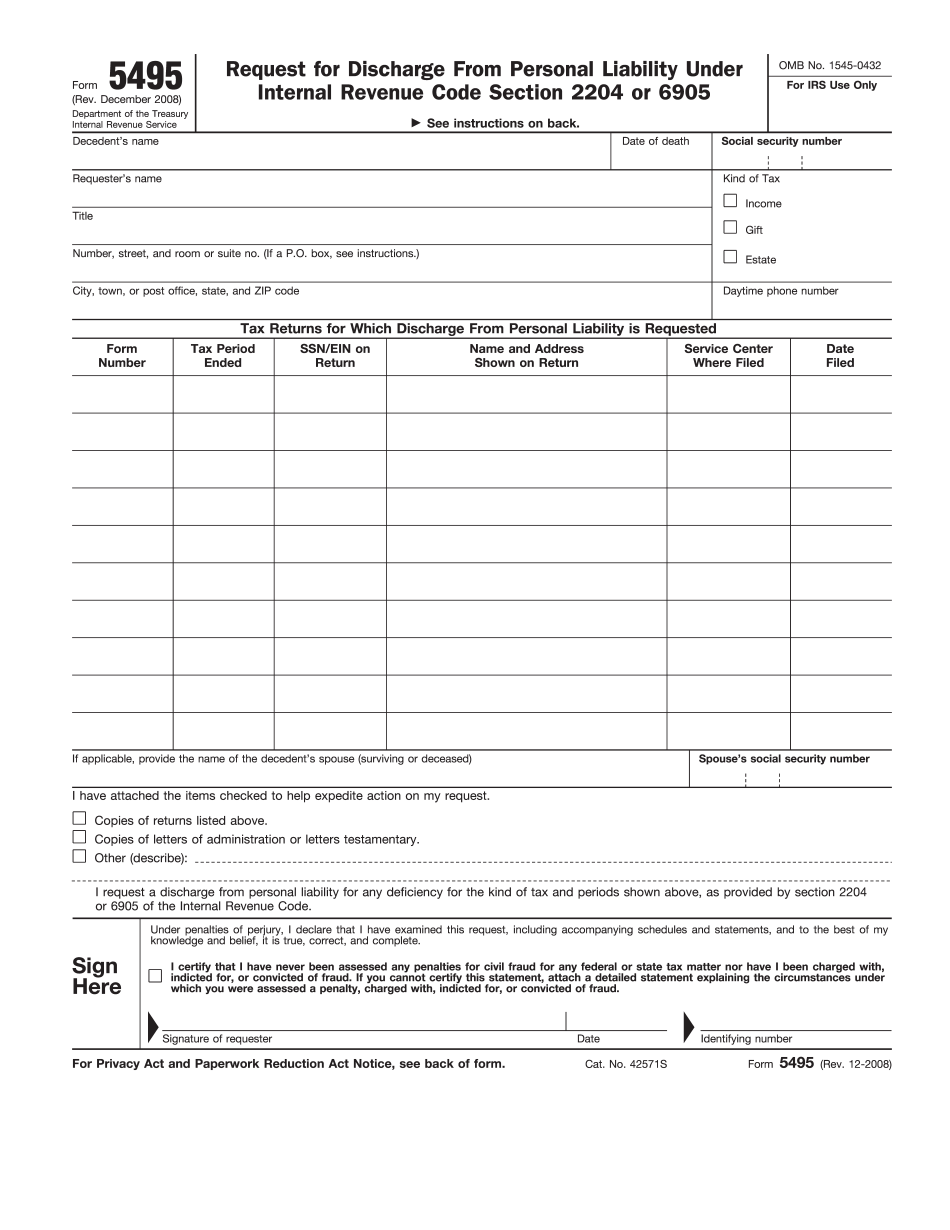

Video instructions and help with filling out and completing When Form 5495 Deductions