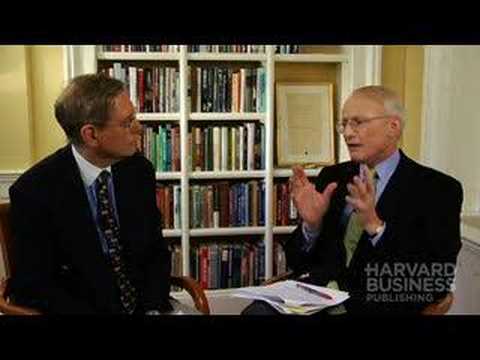

I'm Tom Stewart, editor and managing director of the Harvard Business Review. Our guest today is Michael Porter, professor at Harvard University and head of the Institute for Strategy and Competitiveness. He is the author of the forthcoming HBR article, "The Five Competitive Forces that Shape Strategy," a reaffirmation, update, and extension of his groundbreaking 1979 article, "How Competitive Forces Shape Strategy." Mike, thanks for joining the program. To start, let's remind our viewers of what the five competitive forces are. Well, Tom, the basic idea of the competitive forces starts with the notion that competition is often looked at too narrowly by managers. And the Five Forces say that yes, you're competing with your direct competitors, but you're also in a fight for profits with a broader extended set of competitors: customers who have bargaining power, suppliers who can have bargaining power, new entrants who might come in and kind of grab a piece of the action, and substitute products or services that essentially place a constraint or a cap on your profitability and growth. So the Five Forces is kind of a holistic way of looking at any industry, understanding the structural underlying drivers of profitability and competition. So I use these to think about my rival makes it difficult for me. The threat of substitutes means I can't overcharge. The threat of new entrants means I can't overcharge, right? And the same thing with the bottle advisors class. And the end there's underlying drivers of each of those forces that the model really sort of unveils. And then you can actually apply this every industry is different. Every industry will have a different set of economic fundamentals. But the Five Forces help you home in on, first of all, what's really causing profitability in your industry, what are the...

Award-winning PDF software

Video instructions and help with filling out and completing What Form 5495 Strategies