Hello, hello, hello! Face, you're gonna set this up. Get my hand out of the screen, alright? Okay, okay, okay. So, dive into this. If you want, I was having lunch with my friend, girl, and I would tag her in this video once I'm finished. You know what? I don't want to write anything. I'm trying, but we had lunch this week and the connection was so bad that I had to reboot the internet. I don't want to be talking when it's not a live stream. Anyway, I went to this green town called Kiki, so I'll just say this while recording. I hope something goes right. Okay, now it's back! My internet connection temporarily went out, but when it was working, I was having lunch with my friend earlier this week. I wanted to tag her in this video once I stopped driving. My destination is my bedroll, just kidding! She was explaining to me some of the new tax changes, but I won't go into details since it's not my area of expertise. However, people are losing a lot of deductions due to Trump's new tax laws. For example, if you work from home for your employer, many of those tax deductions you were able to claim before, you can no longer claim on your tax return. Even with mortgage interest rates, certain limits apply. Well, I forgot the specific number. Maybe Tim can come in to correct me in the video. If your deductions don't equal up to around $18,000, like your ties, offerings, and interest rates, then you're not able to claim those deductions on the federal side. However, you can still claim them on the state side. That's why I recommend getting your taxes done by Timlin and his professional staff of experts...

Award-winning PDF software

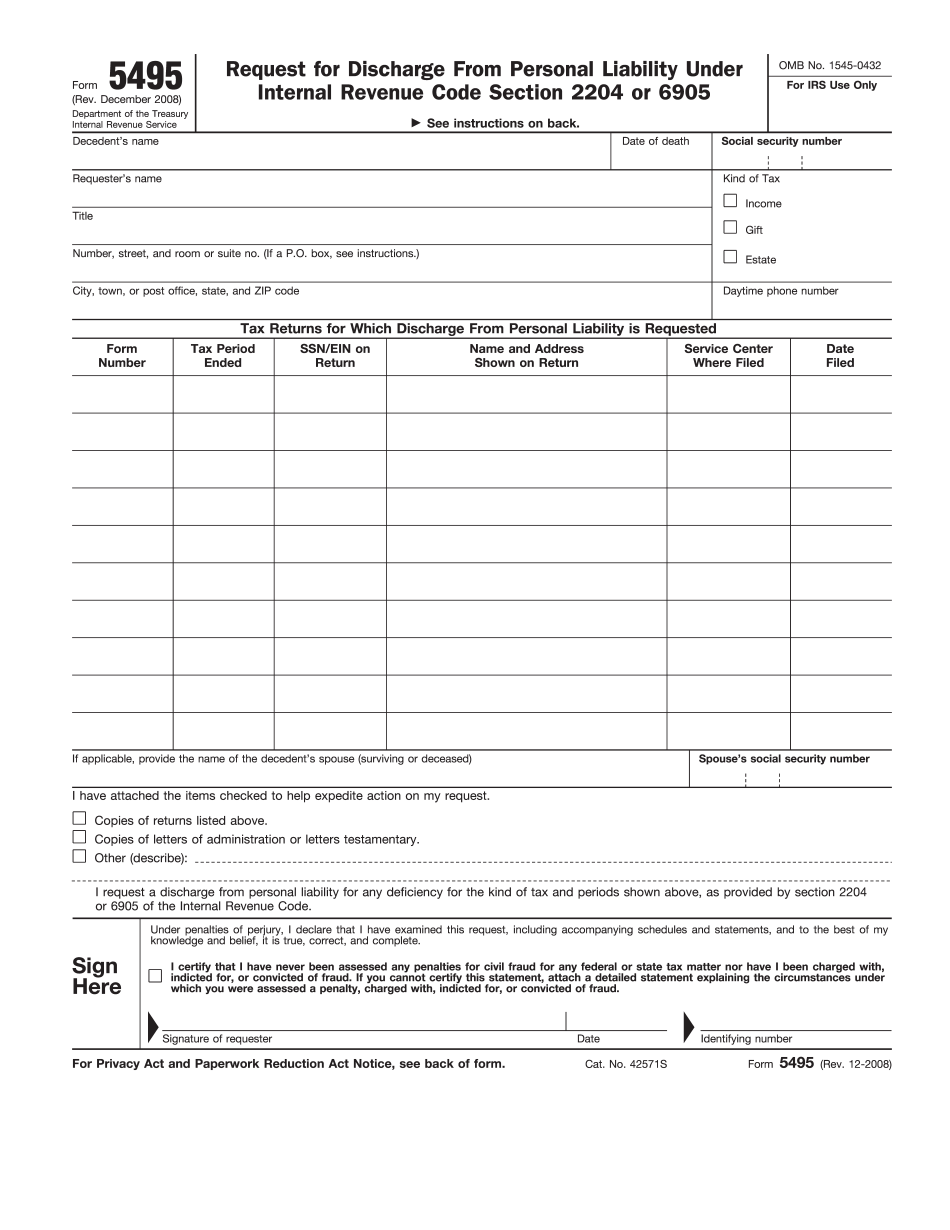

Video instructions and help with filling out and completing How Form 5495 Refunds