I've saved my discussion of limited liability companies or LLC's for last. First, because they are relatively speaking the new kid on the block. Second, they're a hybrid entity. The first LLC was formed in Wyoming in 1977 and it caught on like wildfire due to the personal asset protection and tax flexibility it offered its owners. An LLC is a hybrid business entity, combining many of the positive characteristics of both a corporation and a partnership. Presumably giving the owners the best of both worlds. Like a corporation, an LLC is a legally distinct entity separate from its owners. It has the power to sue and be sued just like a corporation. It provides similar limited liability protection as that of a corporation but has the pass-through tax benefits of a sole proprietorship and partnership. An LLC comes into existence when prospective members file a charter document with a state's business entities Department, which is usually the Secretary of State. The owner of the Nell Elsie are called members, and membership units represent a member's ownership interest. An LLC can have one or more members. LLC's offer a flexible management structure. They can be either member-managed or manager-managed. In a member-managed LLC, each member has an equal voice in the decision-making process of the company, much like partners in a partnership. Most LLC's are member-managed. In a manager-managed LLC, the members specifically designate a manager or managers who may or may not also be members to manage the company, much like officers in a corporation. By default, the IRS treats single-member LLC's as a sole proprietorship and multiple-member LLC's as partnerships, meaning that they are initially treated as pass-through entities. However, all LLC's can elect to be taxed as either a C or S corporation by filing form 8832 with the IRS. So,...

Award-winning PDF software

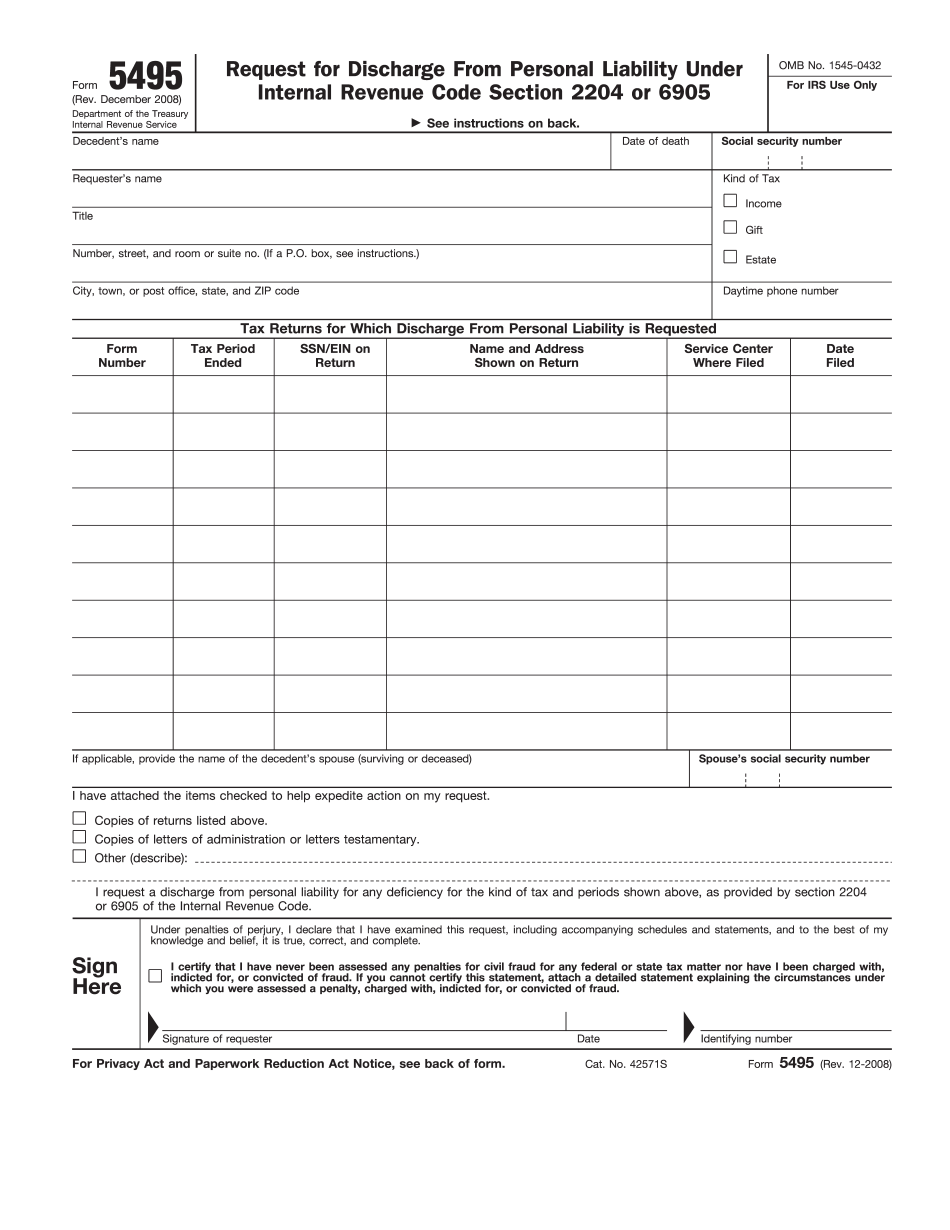

Video instructions and help with filling out and completing How Form 5495 Liabilities