Hi, I'm Michelle and I work for the Internal Revenue Service. If you're an employer, the size of your workforce determines some of your requirements under the health care law. Although the vast majority of employers have a workforce size that falls below the threshold for several of these tax provisions, Applicable Large Employers or ALEs have specific reporting requirements and are subject to the employer shared responsibility provisions. Your workforce size during the current year determines your ALE status for the next year. It's important to determine your ALE status each year because changes in the size of your workforce can affect your status and your requirements from one year to the next. So let's look at how you determine your workforce size and ALE status. You're considered an ALE if the average size of your monthly workforce for the prior calendar year was 50 or more full-time employees, including full-time equivalents. For these tax provisions, employees are considered full-time for a calendar month if they average at least 30 hours of service per week or 130 hours per month. Now, to determine the number of full-time equivalent employees, add up the monthly hours worked by the employees who are not full-time, but don't include more than 120 hours for any employee. Then divide that total by 120. We have several examples on irs.gov to help you figure out which employees to count and how to count them, including special rules for seasonal employees. Here's one more thing to keep in mind: if your business is part of a larger group of employers or businesses that are under common ownership or control, you may be considered an ALE even though your workforce is smaller than 50 employees. To determine the ALE status of the entire group, average all the full-time employees, including full-time...

Award-winning PDF software

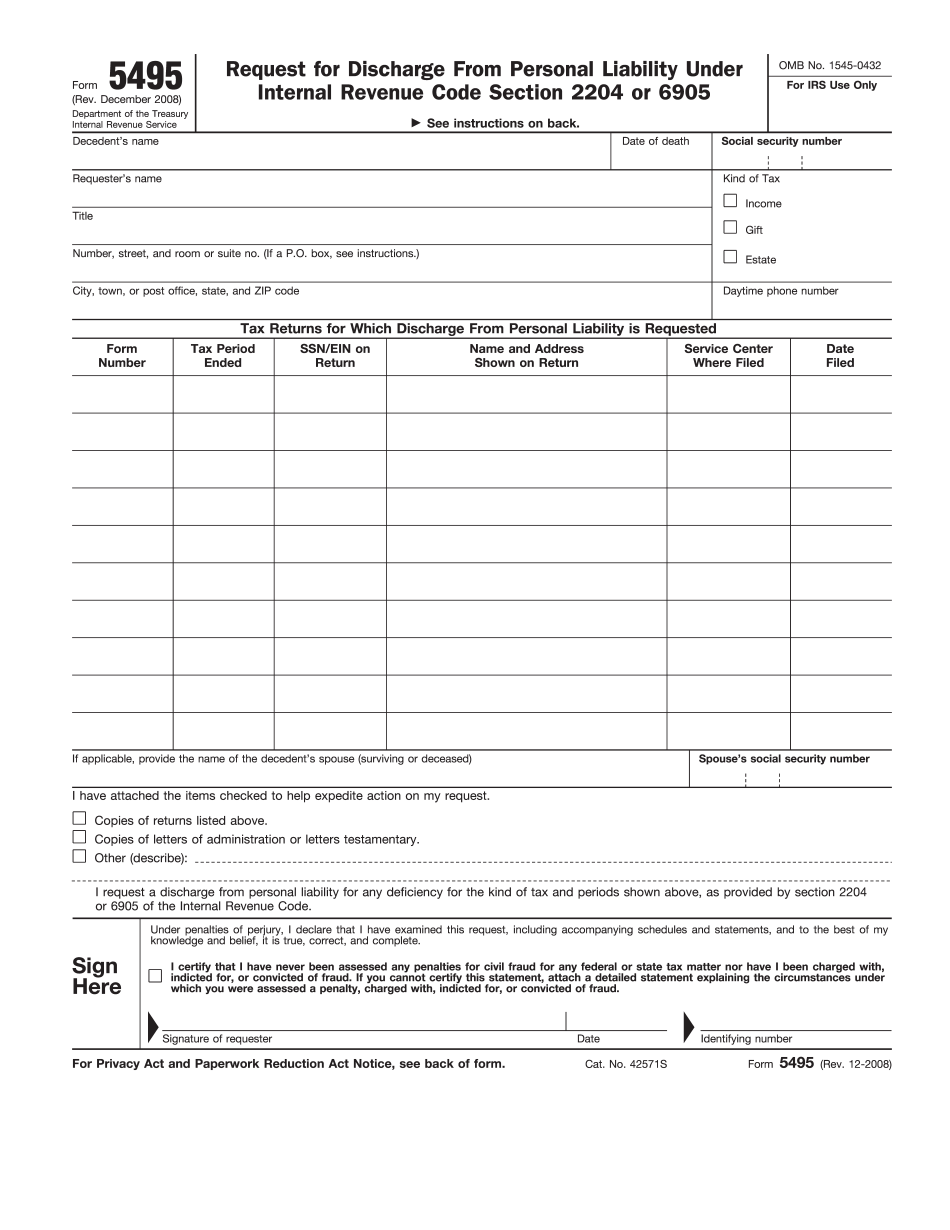

Video instructions and help with filling out and completing How Form 5495 Applicable