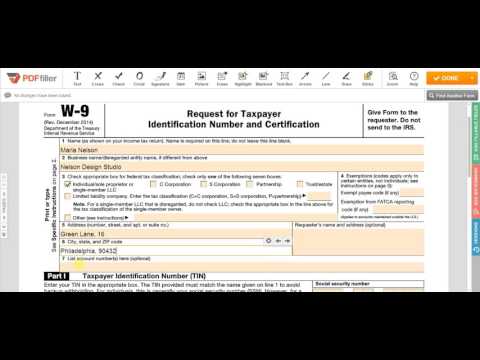

Here is a step-by-step guide on how to use the IRS W-9 form: individuals and business entities use this form to provide their taxpayer identification number to entities that will pay them income during the tax year. The employer uses your W-9 for payroll purposes but doesn't send the form to the Internal Revenue Service. Instead, they use the information to prepare employee paychecks during the year and W-2 forms at the end of the year. Let's take a closer look at how to actually fill it out using PDF filler, our online editor. Step number one is to enter your full name. Step number two is to enter your business name, but only if it differs from the one mentioned above. The next field is to check the federal tax classification of the submitter. Only one of the following options should be checked. In our case, it is individual/sole proprietor or single-member LLC. Step number four is for exemptions. If you are exempt from backup withholding and/or the Foreign Account Tax Compliance Act reporting, you should enter any applicable codes. Generally, individuals, including sole proprietors, are not exempt from backup withholding, so in our case, this is not applicable. Steps number five and six are for the address. Please note that it should be your business address. If you don't have one, just indicate your home address. Next, you will need to provide your social security number or employer identification number. The latter can only be indicated if you have requested and already received one. Finally, you have to sign and date the form. Luckily, with PDF filler, you don't need to print out the form. You can sign and date directly in the editor. By pressing the signature fields, you can add the signature immediately in the editor or choose a previously used...

Award-winning PDF software

Video instructions and help with filling out and completing Fill Form 5495 Taxpayer