Okay, I'm gonna run through real quick here the process I went through earlier, just this morning, when I obtained an EIN number for my grandmother's estate. The estate that I'm the executor for. Simple process, easy to do. It only takes maybe 10 minutes or so to do it, but there are a few tricky places that I'll try my best to explain to you how I handled them. Alright, first thing, went to estate tax ID number first. Now, a lot of these people are advertising because they want to do it for you and charge you for it, or they want to tell you how to do it and charge you for that. I'm going to tell you right now, for free, and you'll be able to get an estate tax ID number easily, quickly, in minutes online for free. Now, your city, they're not telling you, I'm not a lawyer, I'm not giving legal advice, and I'm not telling you to do it on your own without a lawyer, that's up to you. You kind of have to make the judgment call as with all these things, whether it's worthwhile to pay the lawyer or not, sometimes it is, but especially if you have a big complicated estate. But anyway, I'll try to point out the issues as I solve them first. I do click on the IRS, I go there, plan for employer identification number, click apply online now. Oh, you might have noticed on that screen, talked about hours of operation. I ran into that last night, tried to apply it 11 o'clock at night for whatever reason, even though it's all done online, all automated, they're only open certain hours. I think it's between 7:00 in the morning and 10:00 at night or...

Award-winning PDF software

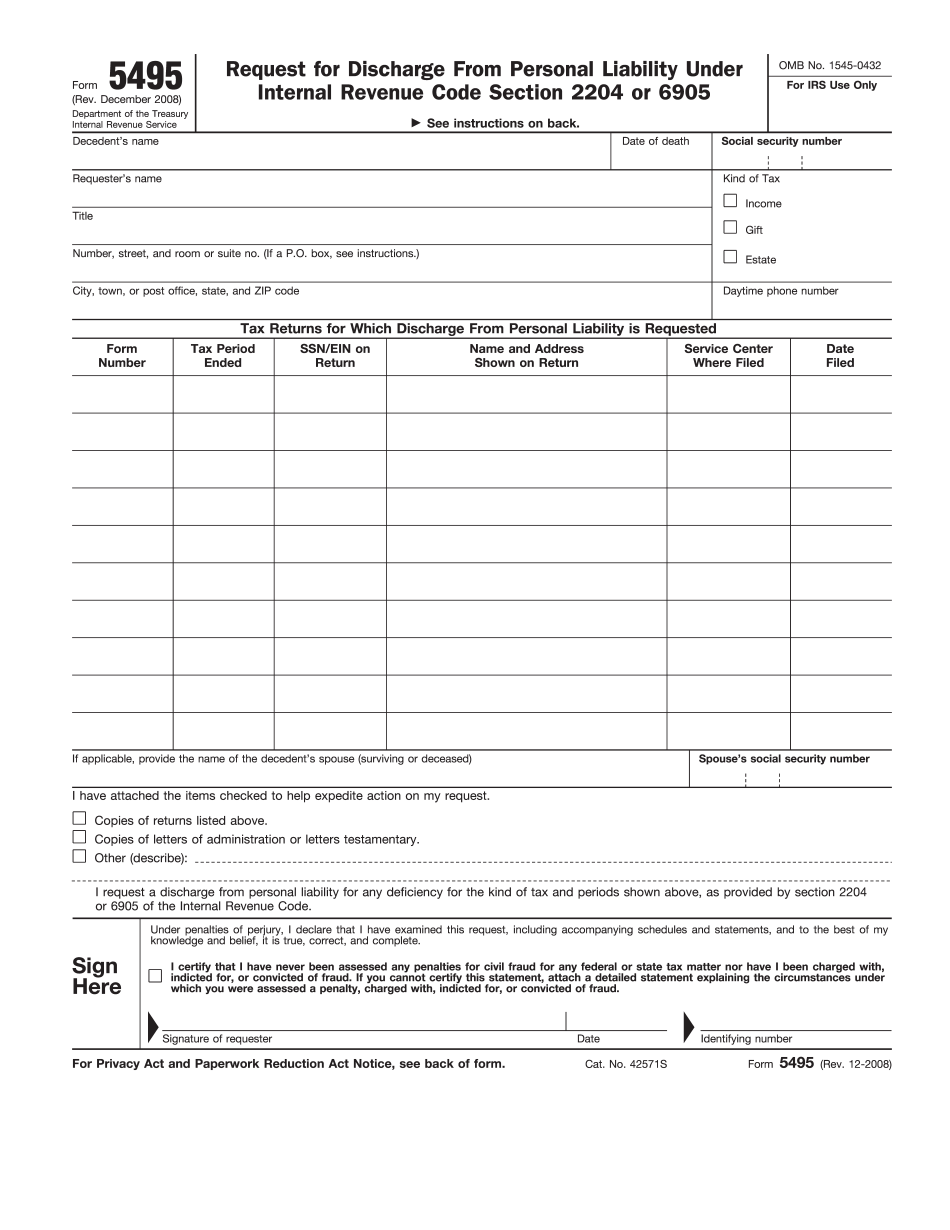

Video instructions and help with filling out and completing Fill Form 5495 Estates