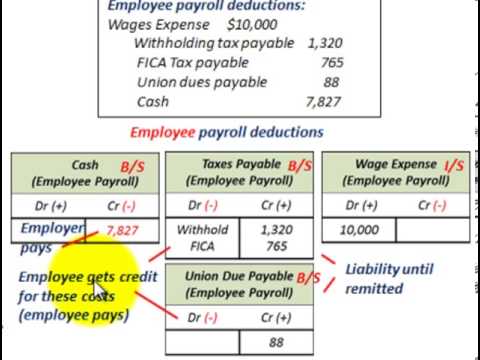

Here is the corrected and divided text: What we're going to be going through here are some employee-related liabilities here, specifically looking at payroll deductions. Now, common types of payroll deductions are taxes, insurance premiums, employee savings, and union dues that the employee would be paying. If a company has not remitted the amounts deducted to the proper authority here for these payroll deductions at the end of the accounting period, it should recognize them here as a current liability. The company would recognize current liability for whatever those payroll deductions are. Now, let's just look at some examples, some governmental types of payroll withholding taxes here, and first would be Social Security taxes or the FICA tax here. You report the amount of unremitted tax on the gross wages paid as a current liability here and as an operating expense. Now, looking at unemployment taxes or food is as they refer to it here, you'd record the amount of a crude but unpaid employer contributions as an operating expense and as a current liability when preparing your financial statements. For income tax withholding, you'd have both federal and state here. The tax laws require that the employers withhold from each of the employees' pay the applicable income tax due on these wages. So, what you have to do here is determine what your payroll deductions would be. You'd have to classify them by the various items and then determine who pays for each of those items. Then, you'd separate them out, what the employee would be paying here and what the employer would be paying here. In either case here, the employer would report these as liabilities until they remit it. So, the employer is actually taking money out of the employee's pay or their check here and they're setting...

Award-winning PDF software

Video instructions and help with filling out and completing Can Form 5495 Liability