A discharge in United States bankruptcy law, when referring to a debtor's discharge, is a statutory injunction against the commencement or continuation of an action or the employment of process or an act to collect, recover, or offset a debt as a personal liability of the debtor. The discharge is one of the primary benefits afforded by relief under the Bankruptcy Code, and it is essential to the fresh start of debtors following bankruptcy. This is a central principle under federal bankruptcy law. The discharge is also believed to play an important role in credit markets by encouraging lenders, who may be more sophisticated and have better information than debtors, to monitor debtors and limit risk-taking. A discharge of debts is granted to debtors but can be denied or revoked by the court based on certain misconduct of debtors, including fraudulent actions or failure of a debtor to disclose all assets during a bankruptcy case. Some debts, such as alimony and child support, cannot be discharged in bankruptcy, while others, such as student loans, are difficult to discharge and are therefore rarely discharged. The benefit of the discharge injunction is narrower than, but similar to, the benefit afforded by the automatic stay in bankruptcy in the United States. With respect to taxes incurred by the bankruptcy estate, as opposed to the debtor during case administration, a specialized discharge for the trustee, the debtor, any successor to the debtor, and cases commenced on or after October 17th, 2005, the bankruptcy estate is provided in 11 USC paragraph 505B.

Award-winning PDF software

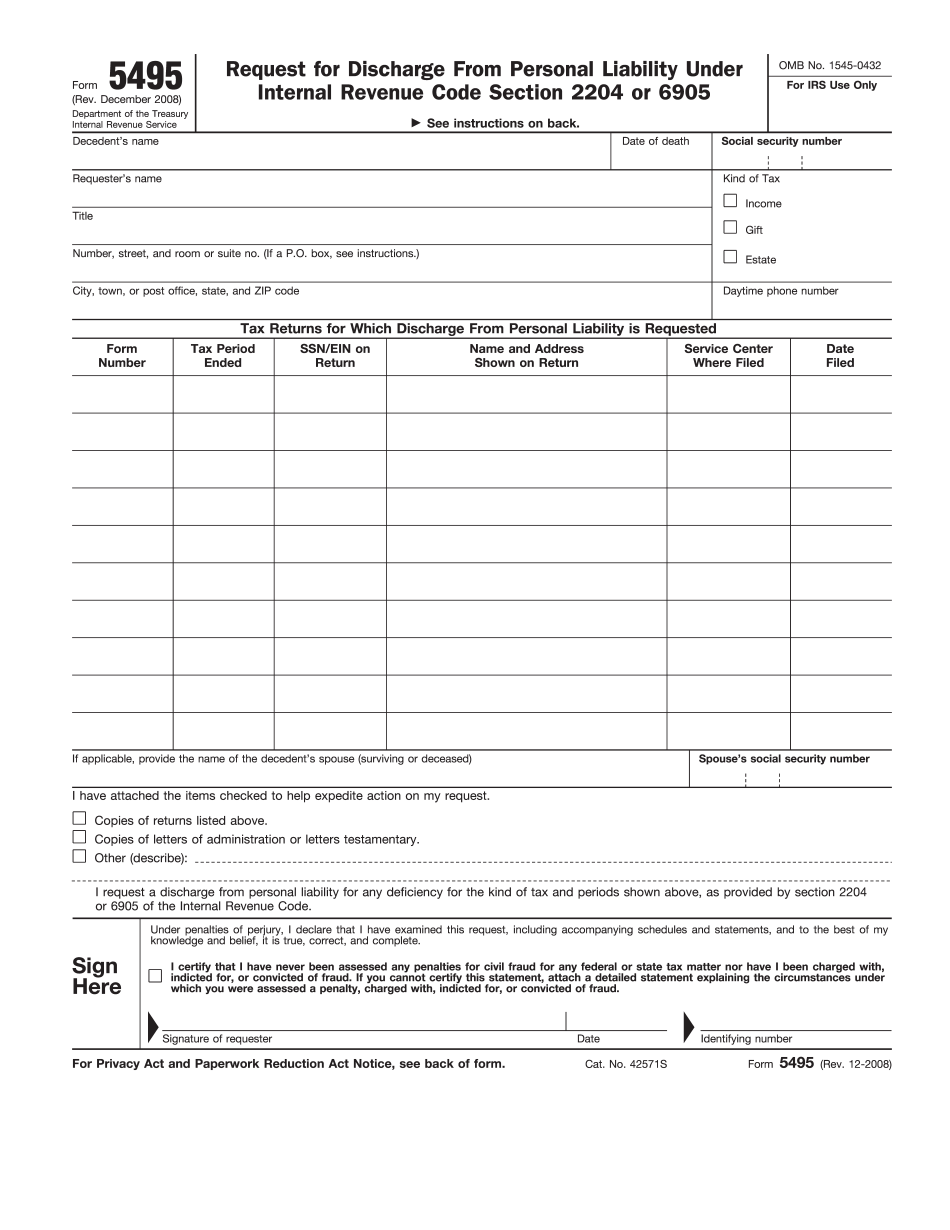

Video instructions and help with filling out and completing Can Form 5495 Discharged